Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, December 31, 2007

Year-end Scoreboard*

S&P 500 1,468.36 +5.49%

DJIA 13,264.82 +8.88%

NASDAQ 2,652.28 +10.66%

Russell 2000 766.03 -1.24%

Morgan Stanley Consumer 737.78 +8.29%

Morgan Stanley Cyclical 1,001.73 +14.72%

Morgan Stanley Technology 622.51 +10.24%

Transports 4,570.55 +1.43%

Utilities 532.53 +20.11%

NYSE Cum A/D Line 60,403 +4.0%

Volatility(VIX) 22.50 +94.6%

AAII % Bulls 30.0 -34.8%

AAII % Bears 50.0% +38.9%

US Dollar 76.63 -7.9%

CRB 358.71 +16.75%

10-year yield 4.03% -67 basis points

Style Performance

Large-cap Growth 611.94 +11.81%

Large-cap Value 796.04 -.18%

Mid-cap Growth 453.10 +11.42%

Mid-cap Value 1,085.23 -1.42%

Small-cap Growth 421.17 +7.05%

Small-cap Value 1,059.69 -9.76%

This Year’s Winners

This Year’s Losers

*1 Year Total Return

Stocks Finish Near Session Lows on Year-end Profit-taking in Best Performing Sectors

Market Summary

Today’s Movers

Market Performance Summary

WSJ Data Center

Sector Performance

ETF Performance

Style Performance

Commodity Movers

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Commentary

After-hours Movers

After-hours Stock Quote

In Play

Stocks Lower into Finaly Hour as Profit-taking Offsets Short-covering

Today's Headlines

Bloomberg:

- Nasdaq Stock Market(NDAQ) obtained clearance from the Committee on Foreign Investment in the US for Borse Dubai to take a stake in the company, paving the way for its acquisition of OMX AB.

- Pakistan’s Election Commission will announce tomorrow whether the Jan. 8 parliamentary vote should be delayed in response to rioting that erupted after last week’s assassination of main opposition leader Benazir Bhutto.

- Copper is falling 1.0% today, heading for the smallest annual gain since 2001.

- Europe’s Dow Jones Stoxx 600 Index posted its first annual decline since 2002, as benchmarks in the UK and France dropped on the last day of trading in 2007.

- Borrowing costs for Citigroup, AT&T and hundreds of US investment-grade corporate bond issuers may fall next year as they refinance about $557 billion of bonds, according to data compiled by Bank of America.

- Delta Petroleum(DPTR), the US oil and gas producer that has posted five straight quarterly losses, said billionaire Kirk Kerkorian’s Tracinda Corp. will buy 35% of the company for $684 million.

Wall Street Journal:

- A veteran space scientist turned entrepreneur is making a big bet that a new generation of small, low-cost satellites can revolutionize the collection of weather and environmental data used to track storms and monitor climate shifts.

- Celanese Corp., Dow Chemical and Anglo American Plc are among Western companies seeking to profit from a Chinese boom in coal-to-chemicals projects.

NY Times:

- Disney(DIS) Expands Virtual Games for Children.

- Google’s(GOOG) Market Share Grows and Grows and Grows.

- Mac owners more likely to download music.

iLounge:

- Apple readying HD Radio push for Macworld.

- President Bush signed legislation Monday to allow states and local governments to cut investment ties with Sudan because of the violence in Darfur.

Bear Radar

Style Underperformer:

Small-cap Growth (-.97%)

Sector Underperformers:

Gold (-1.81%), Alternative Energy (-1.74%) and Papers (-1.54%)

Stocks Falling on Unusual Volume:

Existing Home Sales Rise

- Existing Home Sales for November rose to 5.00M versus estimates of 4.97M and an upwardly revised 4.98M in October.

Bull Radar

Style Outperformer:

Mid-cap Growth(-.39%)

Sector Outperformers:

Airlines (+.29%), Restaurants (-.28%) and Semis (-.40%)

Stocks Rising on Unusual Volume:

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Sunday, December 30, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- James Halloran, who helps oversee $35 billion at National City Private Client Group, sees ‘downside’ risks for oil is 2008. (video)

- Richard DeKaser, chief economist at National City Corp., sees ‘better times’ for the US housing market in 2008. (video)

- US and Canadian theaters this weekend set a record for yearly ticket sales, taking in an estimated $9.59 billion.

- The Pakistan Peoples Party named Benzir Bhutto’s son Bilawal as its new leader and said it would participate in parliamentary elections next month.

- President Bush said he is committed to making sure the US economy grows next year, and pledged to work with Congress to see that it happens.

- China, the world’s biggest grain producer, will tax exports of wheat, corn and rice to increase domestic supply and control rising food prices.

- Nickel will lead a decline in industrial metals next year as stockpiles expand and demand slows with the US housing market, a survey of analysts showed.

NY Times:

- The NY Times, the third-largest US newspaper by circulation, named Fox News commentator and Weekly Standard editor William Kristol as a columnist on its Op-Ed page.

- General David Petraeus, the top US commander in Iraq, said violent attacks in Iraq have declined 60% since June. He said the number of car bomb, suicide car bomb and suicide vest attacks was also down about 60% since March. Petraeus attributed the drop in violence to the increase in US and Iraqi troops and officers and more aggressive operations. General Abdul Kareem Khalaf, a spokesman for the Iraqi Interior Ministry, said in a separate briefing that 75% of al-Qaeda’s network and safe havens had been destroyed.

- A look at the winners and the losers behind the most notable mergers and acquisitions of the year.

CNBC.com:

- ‘Dogs of Dow’ Have Subpar Year, Thanks to Citibank.

- Baidu.com’s(BIDU) CFO Dies in Accident.

TheStreet.com:

- Get Your Portfolio in Shape for 2008.

- Google’s(GOOG) Grip Tightens.

SmartMoney:

- Bears Are Full of Bull. The US Economy is faring well despite the housing mess. Just look around.

Business Week:

- Inside Toyota’s Hybrid Truck. The automaker is introducing a concept compact hybrid pickup designed in America, for Americans.

- Will Apple(AAPL) Upset the Rental Cart? A plan to offer online video rentals could turn up the heat on Netflix and Amazon.com – and reinvigorate interest in Apple TV.

- iRobot(IRBT): Ready to Clean Up. The Roomba maker says it’s readying more robots to do the dirty work of cleaning and the fun work of keeping people connected.

- Setting up your HDTV not as easy as it looks; tips to help.

- Southwest(LUV) hopes changes add up to some ch-cha-ching.

CNNMoney.com:

- Growth funds outpace value names in 2007. Funds dedicated to growth companies had surprisingly solid gains for 2007. A tally of mutual fund performance for the year by Lipper Inc. found that one of the broadest mutual fund categories – large-cap US growth funds – had an average return of 14.9% for the year versus a 2.7% gain for large-cap US value funds.

- Deutsche Bank’s Walter sees oil price dropping to $80/bbl. over the next year.

- Oil investing: 2007 a tough act to follow. It was a banner year for energy – the sector was up 30% and crude jumped 60%. But don’t count on a repeat performance in ’08.

- Real Estate: The best- and the worst – of 2007.

- Cars: Best of the best, 2007.

AP:

- Osama bin Laden warned

Newsday.com:

- Wall Street gurus optimistic for ’08.

Financial Times:

- Equity capital markets may receive a boost next year as financial institutions seek to repair their balance sheets.

- Just an illusion? British business looks bright even as consumers fret. Mario Thomas, managing director of Chapter Eight, says his Bradford-based website design company has full order books and is still taking on staff. “I’ve never seen an economy like this before, with all the doom and gloom. But it hasn’t let up for us at all – with existing customers commissioning work and new business flooding in.”

Economist.com:

- China’s markets flashing red. Sooner or later, the world’s hottest market will burn up.

Guardian:

- Nanosolar Inc., a privately held California-based solar-panel maker, has started production of wafer-thick solar cells printed on aluminum film.

- Merrill Lynch(MER) is in talks with Chinese and Middle Eastern sovereign-wealth funds to raise capital through selling another “big” stake in the company, citing London and NY sources.

Auto Motor und Sport:

- General Motors Corp.s(GM) Chevrolet brand sales in Europe increased to a record in 2007, boosted by purchases of cars in

Kyodo News:

- Japan aiming for 30% of households to have solar panels by 2030.

Nihon Keizai:

- Hitachi Ltd. will stop producing small hard-disk drives for use in video cameras and music players as manufacturers increasingly favor flash memory chips as a means of data storage.

Sankei newspaper:

- Mitsubishi Heavy Industries Ltd., France’s Areva SA and Japan Nuclear Fuel Ltd. will form a joint venture in the US to focus on building fast reactor nuclear plants and fuel reprocessing.

Middle East News Agency:

- President Nicolas Sarkozy said

Weekend Recommendations

Barron's:

- Made positive comments on (BK) and (LTR).

- Made negative comments on (COGT).

Citigroup:

- Reiterated Buy on (LM), target $108.

Night Trading

Asian indices are unch. to +.75% on avg.

S&P 500 futures +.06%.

NASDAQ 100 futures unch.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- None of note

Upcoming Splits

- (CMI) 2-for-1

- (GHM) 5-for-4

Economic Data

10:00 am EST

- Existing Home Sales for November are estimated at 4.97M versus 4.97M in October.

Other Potential Market Movers

- Early close for financial futures and options at 1 pm EST.

BOTTOM LINE: Asian indices are higher, boosted by technology and commodity shares in the region. I expect US stocks to open mixed and to rally into the afternoon, finishing modestly higher. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for the weekly market preview by MarketWatch.com.

There are a few economic reports of note and significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Existing Home Sales, NAPM-Milwaukee

Tues. – US Markets Closed

Wed. – ISM Manufacturing, ISM Prices Paid, Construction Spending, FOMC Minutes

Thur. – MBA Mortgage Applications report, EIA Energy Inventory report, Challenger Job Cuts, ADP Employment Change, Initial Jobless Claims, Factory Orders, Total Vehicle Sales

Fri. – Change in Non-farm Payrolls, Average Hourly Earnings, Unemployment Rate, ISM Non-Manufacturing

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – None of note

Tues. – US Markets Closed

Wed. – Immucor(BLUD)

Thur. – Monsanto(MON), Texas Industries(TXI), Bed Bath & Beyond(BBBY), Finish Line(FINL), Global Payment(GPN), Sonic(SONC), Merix(MERX)

Fri. – None of note

Other events that have market-moving potential this week include:

Mon. – None of note

Tue. –

Wed. – None of note

Thur. – None of note

Fri. – The Fed’s Kohn speaking

Friday, December 28, 2007

Weekly Scoreboard*

Indices

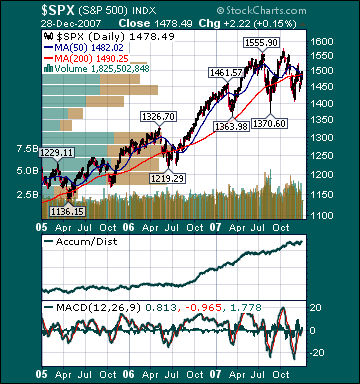

S&P 500 1,478.48 +1.26%

DJIA 13,365.87 +.91%

NASDAQ 2,674.46 +1.27%

Russell 2000 771.76 +.55%

Wilshire 5000 14,847.34 +1.19%

Russell 1000 Growth 616.54 +1.13%

Russell 1000 Value 800.28 +1.28%

Morgan Stanley Consumer 744.24 +.75%

Morgan Stanley Cyclical 999.99 +1.53%

Morgan Stanley Technology 629.30 +.52%

Transports 4,625.57 +.91%

Utilities 537.17 +.09%

MSCI Emerging Markets 152.17 +2.28%

Sentiment/Internals

NYSE Cumulative A/D Line 60,357 +2.68%

Bloomberg New Highs-Lows Index -436

Bloomberg Crude Oil % Bulls 41.0 +156.2%

CFTC Oil Large Speculative Longs 219,382 +2.95%

Total Put/Call .92 +42.86%

NYSE Arms 1.10 +13.26%

Volatility(VIX) 20.71 +.68%

ISE Sentiment 169.0 +53.64%

AAII % Bulls 30.0 -16.3%

AAII % Bears 50.0 +6.0%

Futures Spot Prices

Crude Oil 96.08 +5.59%

Reformulated Gasoline 246.65 +5.54%

Natural Gas 7.36 +1.69%

Heating Oil 264.45 +1.94%

Gold 841.90 +5.07%

Base Metals 214.73 +.28%

Copper 307.70 +3.55%

Economy

10-year US Treasury Yield 4.08% -9 basis points

4-Wk MA of Jobless Claims 342,500 -.3%

Average 30-year Mortgage Rate 6.17% +3 basis points

Weekly Mortgage Applications 603.80 -7.6%

Weekly Retail Sales +1.3%

Nationwide Gas $3.00/gallon +.02/gallon

US Heating Demand Next 7 Days 2.0% below normal

ECRI Weekly Leading Economic Index 135.20 -.73%

US Dollar Index 76.20 -2.02%

CRB Index 358.51 +2.54%

Best Performing Style

Large-cap Value +1.28%

Worst Performing Style

Small-cap Value -.04%

Leading Sectors

Alternative Energy +5.7%

Steel +5.7%

Oil Service +5.6%

Telecom +3.3%

Wireless +2.4%

Lagging Sectors

REITs -.94%

Computer Services -1.23%

Hospitals -1.25%

Retail -1.77%

Airlines -5.0%

Stocks Mostly Lower into Final Hour on More Economic Pessimism, Profit-taking

Today's Headlines

Bloomberg:

- A Taliban commander linked to al-Qaeda is suspected of plotting the suicide attack that killed former Prime Minister Benazir Bhutto, Pakistan’s government said.

- Macy’s Inc.(M), Best Buy(BBY) and Abercrombie & Fitch(ANF) may get a boost in store traffic and revenue in the next few weeks from the redemption of gift cards, which are growing faster than total retail sales.

- The cost of borrowing in dollars, euros and pounds fell, capping a second week of declines, as coordinated central bank action to revive money markets showed signs of success.

- Checkpoint Systems(CKP), the maker of anti-theft tags for retailers, rose the most in nine months after it named a new CEO and forecast 2008 earnings exceeding analysts’ estimates.

- Farmers in

- Crude oil is rising to a one-month high on year-end investment fund mark-ups and a weaker dollar.

- Treasuries rose the most in more than two weeks and headed for the best annual returns since 2002 after a government report showed sales of new homes in the

- Democratic presidential candidate John Edwards said neither of his two major opponents would bring substantial change to the way Washington works – Hillary Clinton doesn’t want to and Barack Obama doesn’t know how.

NY Post:

- NY’s population stays almost unchanged.

Information Times:

-

Bear Radar

Style Underperformer:

Small-cap Value (-.50%)

Sector Underperformers:

Airlines (-2.13%), REITs (-1.28%) and Hospitals (-.80%)

Stocks Falling on Unusual Volume:

Bull Radar

Style Outperformer:

Small-cap Growth(+.69%)

Sector Outperformers:

Foods (+1.51%), Oil Service (+1.21%) and Telecom (+1.09%)

Stocks Rising on Unusual Volume:

Gauge of US Business Activity Jumps to 7-month High, Order Backlogs Soar to 10-year High, New Home Sales Fall

- The Chicago PMI for December rose to 56.6 versus estimates of 51.7 and a reading of 52.9 in November.

- New Home Sales for November fell to 647K versus estimates of 717K and 711K in October.

BOTTOM LINE: The Chicago PMI, a measure of US business activity, unexpectedly rose this month to the highest level since June as new orders increased and businesses reduced stockpiles of unsold goods, Bloomberg reported. Booming exports may help sustain growth in manufacturing, economists said. The New Orders component of the index rose to 58.4, the highest since August, versus 53.9 the prior month. Moreover, the Order Backlogs component soared to 60.7, the highest since January 1998, versus 45.9 in November. The Prices Paid component fell to 63.8 from 76.2 the prior month and the Employment component fell to 49 versus 54.4 in November. This report is a big positive. I continue to believe manufacturing will help boost overall

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Thursday, December 27, 2007

Friday Watch

Late-Night Headlines

Bloomberg:

- The funeral of former Pakistani Prime Minister Benazir Bhutto was set for today after her assassination set off street protests and drew condemnations from leaders inside the country and around the world.

-

- The perceived risk of

Wall Street Journal:

- Chinese securities regulators are preparing to outline new rules that would give global investment banks access to the country’s domestic exchanges.

- Companies in the S&P 500 paid a record $27.73 a share in dividends in 2007, and S%P expects that amount to rise 9.3% in 2008.

CNNMoney.com:

- Beware the dreaded R word. You don’t know whether we’re in a recession until months after it starts. But investing successfully requires looking forward, not backword.

- Apple(AAPL) seen planning own Ne(x)tflix. Surging consumer tech company is developing rental components to iTunes that could dramatically boost digital movies, according to a report.

SmartMoney.com:

- iPhone Could Give Apple(AAPL) Inroad to Enterprise Sales.

IBD:

- With Housing Down, Some Buying Spots The Boom Bypassed.

- US online retail sales from November 23 through December 24 rose 22.4% from the year-earlier figure, Mastercard(MA) Advisor’s SpendingPulse reported on Thursday. And Chase(CCF) Paymentech’s Pulse Index, which uses transaction data from 10 top online merchants, says holiday sales through December 23 were up nearly 30%.

- Nike, Coke try to inspire with New Year’s ads.

Financial Times:

- Bhutto in her own words: ‘Only democracy can defeat Pakistan’s extremists.’

Late Buy/Sell Recommendations

- None of note

Night Trading

Asian Indices are -1.25% to unch. on average.

S&P 500 futures +.26%.

NASDAQ 100 futures +.16%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/EPS Estimate

- None of note

Upcoming Splits

- (TWIN) 2-for-1

- (CMI) 2-for-1

- (GHM) 5-for-4

Economic Releases

9:45 am EST

- The Chicago PMI for December is estimated to fall to 51.7 versus 52.9 in November.

10:00 am EST

- New Home Sales for November are estimated to fall to 717K versus 728K in October.

Other Potential Market Movers

- The weekly EIA natural gas inventory report could also impact trading today.

Stocks Finish at Session Lows on Pakistan News, Profit-Taking

Evening Review

Market Summary

Today’s Movers

Market Performance Summary

WSJ Data Center

Sector Performance

ETF Performance

Style Performance

Commodity Movers

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Commentary

After-hours Movers

After-hours Stock Quote

In Play

Stocks Lower into Final Hour on Pakistan News, Profit-taking and More Economic Pessimism

Today's Headlines

Bloomberg:

- As the US savings and loan crisis worsened in the 1980s, analysts tried to top each other’s estimates of the debacle’s cost to the federal government. Much the same thing is happening now with losses linked to subprime mortgages, with figures of $300 billion to $400 billion being bandied about. A more realistic amount is probably half or less than those exaggerated projections – say $150 billion. That’s hardly chicken feed, though not nearly enough to sink the US economy.

- Pakistan’s Bhutto Assassinated in Attack at Rally.

- The cost of borrowing dollars, euros and pounds fell, adding to evidence that measures by central banks to east the gridlock in money markets are succeeding.

- The Fed will reduce interest rates at every policy setting meeting “for the next two to three quarters,” PIMCO’s Paul McCulley said in a note released today to clients. The central bank will act to “truncate both the length and the severity” of a contraction in lending, McCulley said.

- Crude oil is rising to a one-month high after as investment fund speculation rose after an EIA repot showed

- Wheat fell to a two-week low as rising production in

- Sotheby’s(BID), the world’s second-largest auction house, sold about 46% more art this year as US, Russian and Asian collectors bid up prices for contemporary artists such as Francis Bacon and Jeff Koons.

- Cirrus Logic(CRUS), the maker of computer chips for Bose Corp. and Pioneer Corp., rose more than 5% on the Nasdaq after a fund founded by billionaire George Soros boosted its stake in the company almost sevenfold.

- Pacific Crest analyst Andy Hargeaves said Apple Inc. will meet or exceed his earnings estimates, the Mac will continue to take market share and that Apple is still a good buy over $200.

BloggingStocks:

- Apple’s new price target: $300.

CNNMoney.com:

- Vestas Wind Systems Gets Order From AES For 52 Turbines.

AP:

- Acting New Jersey Governor Richard Codey will sign into law a bill he sponsored that restricts paroled sex offenders from surfing the Internet.

Trends-Tendances:

- European Central Bank council member Guy Quaden said the financial-market turmoil has yet to have a major effect on

Bear Radar

Style Underperformer:

Small-cap Value (-1.86%)

Sector Underperformers:

REITs (-2.49%), Airlines (-2.39%) and Coal (-2.01%)

Stocks Falling on Unusual Volume:

Bull Radar

Style Outperformer:

Large-cap Growth(-.89%)

Sector Outperformers:

Utilities (-.40%) Energy (-.55%) and Computer Hardware (-.54%)

Stocks Rising on Unusual Volume:

Bearish Sentiment Still Exceeds Levels Seen at Depths of 2000-2003 Bear Market

* Notwithstanding historical individual investor pessimism, corporate insiders continue to buy their own stocks hand over fist.

Furthermore, the 50-week moving average of the percentage of bears is currently 38.6%, an elevated level seen during only one other period since tracking began in the 80s. That period was October 1990-July 1991, right near another major stock market bottom. The extreme reading of the 50-week moving average of the percentage of bears during that period peaked at 41.6% on Jan. 31, 1991. The current reading of 38.6% is slightly above the peak during the 2000-2003 bear market, which was 38.1% on April 10, 2003. I find this even more astonishing, notwithstanding the recent pullback, given that the S&P 500 is currently 105% higher from the October 2002 major bear market lows and just 4.6% off a record high.

Individual investor pessimism towards US stocks is currently deep-seated and historical in nature. This is just more evidence of the current “Durable Goods Orders Rise, Jobless Caims Rise Slightly, Consumer Confidence Improves

- Durable Goods Orders for November rose .1% versus estimates of a 2.0% gain and a .4% decline in October.

- Durables Ex Transports for November fell .7% versus estimates of a .5% increase and a .9% decline in October.

- Initial Jobless Claims for this week rose to 349K versus estimates of 340K and 348K the prior week.

- Continuing Claims rose to 2713K versus estimates of 2645K and 2638K prior.

- Consumer Confidence for December rose to 88.6 versus estimates of 86.5 and a reading of 87.8 in November.

BOTTOM LINE: Orders for US durable goods rose less than forecast in November, partially restrained by a drop in defense orders, Bloomberg reported. Orders for military equipment fell 24%. However, Bookings Excluding Defense Equipment rose 1.2%. Orders for non-defense capital goods excluding aircraft, a gauge of future demand, declined .4% versus a 2.9% decline in October. Shipments of those items, used in computing GDP, rose .2% versus a 1.2% drop in October. Orders for transportation equipment rose 1.9%, boosted by a 21% jump in commercial aircraft demand. I expect Durable Goods Orders Ex Transports to rebound next month on inventory rebuilding.

The number of Americans filing first-time jobless claims for unemployment insurance rose slightly last week, Bloomberg reported. However, the four-week moving-average of new claims fell to 342,500 from 343,500. As well, the unemployment rate among those eligible to collect benefits, which tracks the

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Wednesday, December 26, 2007

Thursday Watch

Late-Night Headlines

Bloomberg:

- The yuan rose the most since

- Amazon.com Says 2007 Holiday Season Is ‘Best Ever.’

Wall Street Journal:

- Congress Adds $10 Billion In Earmarks to 2008 Budget.

- ‘Long-Short’ Funds Labor to Thrive.

NY Times:

- Las Vegas Wins Big. Revenues on the Vegas strip are rising, even as rival casinos struggle.

- Inside Apple(AAPL) Stores, a Certain Aura Enchants the Faithful.

MarketWatch.com:

- Apple(AAPL) driven to record by strong iPhone, Mac sales.

BusinessWeek.com:

- Semiconductors: Healthy M&A Prospects. S&P says some recent deals show that chip companies are finding attractive prices and ways to improve by combining.

- The founder of Rembrandt Venture Partners offers predictions for next year and advice for entrepreneurs seeking funding.

CNNMoney.com:

- Hiring in ’08: Slower but steady gains.

IBD:

- Social Networking Has Taken Off With Users, Investors Swelling.

Forbes.com:

- Asset-management firm Davis Selected Advisers seems to be calling a bottom in the US financial services market. On Wednesday, it said it had acquired a 5.1% stake in MBIA(MBI), the world’s largest bond insurer, just two days after it pumped $1.2 billion into Merrill Lynch(MER).

- Unprecedented losses at Bear Stearns(BSC) couldn’t shake Joseph Lewis’s interest in the troubled brokerage. The British billionaire is still buying shares even after the company’s abysmal fourth quarter.

- Publicity over Ford Flex gains muscle with leisurely test drives.

Reuters:

- Buffet bets on America with latest purchase.

Financial Times:

- Apple Inc.(AAPL) and News Corp.’s(NWS/A) Twentieth Century Fox will start a service that lets consumers download films and rent them for a limited time.

Late Buy/Sell Recommendations

Citigroup:

- 8 Plausible and Interesting 2008 Outcomes: 1) The Republicans hold on to the White House – essentially, divided government remains the desire of the American people. 2) Oil prices fall to $70-75/bbl. alongside slower growth in the

- 8 Questions We Are Not Hearing?: 1)Where should I consider buying real estate? General agreement is that prices are headed lower but no sense of where “value” is? 2) Doesn’t the yield curve steepness mean anything anymore for Financial sector earnings? 3) Why aren’t energy companies earning more with oil near $100/bbl. 4) Whatever happened to the problems of under-funded pension programs that were supposed to be the undoing of US public companies? 5) Why doesn’t the fact that 95% or more of equity mutual fund flows going to international funds in the past few years worry more people about a new stock investing craze outside the

Night Trading

Asian Indices are unch. to +1.25% on average.

S&P 500 futures -.17%.

NASDAQ 100 futures -.12%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/EPS Estimate

- (LUB)/.07

- (CBK)/.28

- (ACIW)/.33

Upcoming Splits

- (

- (TWIN) 2-for-1

Economic Releases

8:30 am EST

- Durable Goods Orders for November are estimated to rise 2.0% versus a .2% decline in October.

- Durables Ex Transports for November are estimated to rise .5% versus a .4% decline in October.

- Initial Jobless Claims for this week are estimated to fall to 340K versus 346K the prior week.

- Continuing Claims are estimated to fall to 2645K versus 2646K prior.

10:00 am EST

- Consumer Confidence for December is estimated to fall to 86.5 versus 87.3 in November.

10:30 am EST

- Bloomberg consensus estimates call for a weekly crude oil drawdown of -1,625,000 barrels versus a -7,586,000 barrel decline the prior week. Gasoline supplies are expected to rise by 1,550,000 barrels versus a 2,980,000 barrel increase the prior week. Distillate inventories are estimated to fall by -900,000 barrels versus a -2,158,000 barrel decrease the prior week. Finally, Refinery Utilization is estimated to rise by .7% versus a -.92% decline the prior week.

Other Potential Market Movers

- The weekly MBA mortgage applications report could also impact trading today.