Broad Market Tone: - Advance/Decline Line: Higher

- Sector Performance: Most Sectors Rising

- Volume: Below Average

- Market Leading Stocks: Underperforming

Equity Investor Angst: - VIX 15.58 +.65%

- ISE Sentiment Index 100.0 -15.25%

- Total Put/Call .99 -3.88%

- NYSE Arms 1.13 +25.89%

Credit Investor Angst:- North American Investment Grade CDS Index 91.15 -1.82%

- European Financial Sector CDS Index 220.25 +1.18%

- Western Europe Sovereign Debt CDS Index 268.84 -1.60%

- Emerging Market CDS Index 244.62 -.50%

- 2-Year Swap Spread 25.0 +.25 basis point

- TED Spread 40.25 -1.0 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -50.50 -.5 basis point

Economic Gauges:- 3-Month T-Bill Yield .07% +1 basis point

- Yield Curve 188.0 +6 basis points

- China Import Iron Ore Spot $147.60/Metric Tonne -.07%

- Citi US Economic Surprise Index 18.90 -.7 point

- 10-Year TIPS Spread 2.34 +3 basis points

Overseas Futures: - Nikkei Futures: Indicating a +102 open in Japan

- DAX Futures: Indicating a +21 open in Germany

Portfolio:

- Slightly Higher: On gains in my Biotech and Medical sector longs

- Disclosed Trades: Covered all of my (IWM)/(QQQ) hedges and some of my (EEM) short, then added them back

- Market Exposure: 75% Net Long

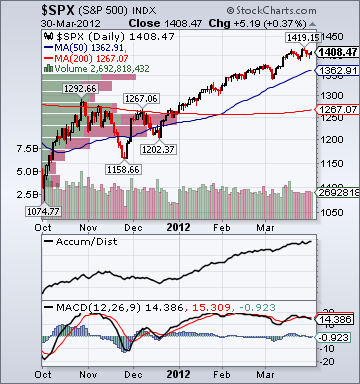

BOTTOM LINE: Today's overall market action is mildly bullish, as the S&P 500 trades near session highs on some better US economic data, more financial sector optimism, a bounce in the euro, short-covering, investor performance angst and window-dressing. On the positive side, Oil Service, Ag, Semi, HMO and REIT shares are especially strong, rising more than +1.0%. Financials have traded well throughout the day. Copper is gaining +.84%. The 10Y Yld is rising +6 bps to 2.22%. Major Asian indices were mostly higher, led by a +2.0% gain in India. The Shanghai Composite bounced +.47%, but is down -3.7% over the last 5 days and has cuts its gains for the year to +2.9%. As well,

China’s ChiNext Index of smaller growth-oriented companies fell another -.8% overnight and is down -8.1% this week. Major European indices are rising around +.75%, led by a +1.3% gain in France. Spanish shares are bouncing +1.2% today, but are down -3.3% this week and -6.5% ytd, which remains a large red flag for the region. The Bloomberg European Financial Services/Bank Index is rising +1.0% today. The Germany sovereign cds is down -3.3% to 73.66 bps, the France sovereign cds is down -2.2% to 169.41 bps, the Portugal sovereign cds is down -2.0% to 1,073.11 bps and the UK sovereign cds is down -2.5% to 62.83 bps. On the negative side,

Homebuilding, Airline, Education and Coal shares are under pressure, falling more than -.75%. Gold is rising +.5%, the UBS-Bloomberg Ag Spot Index is jumping +3.1% and Lumber is falling -1.3%. The Italy sovereign cds is gaining +1.3% to 396.51 bps and the Japan sovereign cds is up +.91% to 99.48 bps. The Philly Fed ADS Real-Time Business Conditions Index continues to trend lower from its late-December peak despite investor perceptions that the US economy is accelerating.

Moreover, the Citi US Economic Surprise Index has fallen back to early-Nov. levels. Lumber is -9.0% since its Dec. 29th high despite the better US economic data, dovish Fed commentary, improving sentiment towards homebuilders, equity rally and decline in eurozone debt angst. Moreover, the weekly MBA Home Purchase Applications Index has been around the same level since May 2010. The Baltic Dry Index has plunged around -60.0% from its Oct. 14th high and is now down around -45.0% ytd. China Iron Ore Spot has plunged -18.5% since Sept. 7th of last year. Shanghai Copper Inventories are right near a new record and have risen +741.0% ytd. I still think this is more of a red flag for falling demand rather than the intentional hoarding, which many suggest. US stocks continue to trade very well as every small dip is still seen as a buying opportunity and almost all negatives are ignored. Investor complacency is fairly high again given the recent deterioration in the macro backdrop. Some market leaders, such as my (AAPL) long, are beginning to roll over a bit. Volume is especially light for a quarter-end.

I would like to see the market prove itself after quarter-end before becoming more aggressive on the long-side. For the recent equity advance to regain traction, I would still expect to see further European credit gauge improvement, a further subsiding of hard-landing fears in key emerging markets, a rising 10-year yield, better volume, stable-to-lower energy prices and higher-quality stock market leadership. I expect US stocks to trade mixed-to-higher into the close from current levels on short-covering, more financial sector optimism, a bounce in the euro, some better US economic data, window-dressing and investor performance angst.