S&P 500 1,123.12 -.48%

NASDAQ 1,908.91 -.06%

Leading Sectors

Semis +2.90%

Oil Service +.89%

Disk Drives +.88%

Lagging Sectors

Drugs -1.27%

Broadcasting -1.41%

Tobacco -1.54%

Other

Crude Oil 45.75 +.35%

Natural Gas 5.16 +1.12%

Gold 406.60 -.25%

Base Metals 111.05 +1.35%

U.S. Dollar 88.99 +.15%

10-Yr. T-note Yield 4.07% -.75%

VIX 14.44 +2.92%

Put/Call 1.02 +24.39%

NYSE Arms 1.03 +41.10%

Market Movers

UTSI -8.9% after lowering 3Q estimates significantly.

CL -10.5% after lowering 3Q/4Q forecasts.

OSIP +7.9% after saying that its experimental Tarceva drug combined with chemotherapy helped patients with pancreatic cancer live longer in a study.

SJH +7.4% after saying Fortress Investment Group agreed to acquire it for about $677 million in cash.

ACH +6.4% on speculation the Chinese economy would accelerate and the company is raising prices.

MOND +4.6% after saying it expects to raise $400 million to $500 million after taxes through sales of assets to focus on its premium labels.

WMGI -12.63% after it cut its 3Q/04 outlook, citing a recall on its metal acetabular hip cups.

ROG -12.2% after cutting 3Q forecast substantially.

TFX -8.7% after cutting 3Q and 04 outlook substantially.

UL -5.1% after reducing 04 forecast.

Economic Data

NAHB Housing Market Index fell to 68 in September versus estimates of 70 and a reading of 71 in August.

Recommendations

Goldman Sachs reiterated Underperform on CL, F and EK. Goldman reiterated Outperform on DNA, AMLN, ROH, ACS, CAN, PG, CTSH, IGT, SLR, FS and BAX. Citi SmithBarney reiterated Buy on CCL, target $54. Citi reiterated Buy on WMT, target $65. Citi rated ELOS Buy, target $21. AUDC cut to Reduce at UBS, target $10.50. PKY cut to Reduce at UBS, target $44. APOL cut to Reduce at UBS. CECO cut to Reduce at UBS, target $27. TRDO cut to Underweight at JP Morgan. NBP, MCIP, GGC, WLK rated Overweight at JP Morgan. ZMH raised to Outperform at Bear Stearns, target $93. WLK rated Buy at Bank of America, target $24.

Mid-day News

U.S. stocks are modestly lower mid-day on earnings worries and rising oil prices. America Online Vice Chairman Ted Leonsis told financial news network CNBC AOL might enhance its Web site to add to advertising sales, Bloomberg said. Reality tv producer Mark Burnett has discussed making changes with Martha Stewart about her tv show once her prison time and home confinement are completed, the NY Daily News reported. Google must expand outside the U.S. to succeed, particularly in Asia, where the potential for growth is the greatest, the San Francisco Chronicle reported. Nike said first-quarter earnings surged 25% as demand for Shox running shoes and Converse sneakers fueled the fastest U.S. sales gain in more than a year, Bloomberg reported. Iraq should go ahead with plans for an election in January to hand a "big defeat" to terrorists, who are trying to undermine the country's stability, Prime Minister Allawi told the U.K.'s GMTV. A U.S. judge struck down more than 12 of the government's current political fund-raising rules, because she said the regulations improperly weaken campaign finance law, the AP reported. Viacom's CBS said the tv network can't prove the authenticity of documents it had used to raise questions about President Bush's National Guard service and that using them was a "mistake", Bloomberg reported. Crude oil is rising to a four-week high after OAO Yukos Oil said it will halt shipments to China's biggest oil company because its bank accounts have been frozen by the Russian government, Bloomberg said.

BOTTOM LINE: The Portfolio is lower mid-day on declines in my security, education and homebuilding longs. I took profits in a few internet and education longs this morning, thus leaving the Portfolio 75% net long. While most stocks are lower today, it is a positive to see strength in technology shares and specifically the semiconductor sector. As well, measures of investor anxiety are climbing towards more healthy levels. I continue to expect stocks to consolidate recent gains through mid-October, setting the stage for a very good fourth quarter. I expect U.S. stocks to trade mixed into the afternoon.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, September 20, 2004

Monday Watch

Earnings of Note

Company/Estimate

ADBE/.39

KMX/.27

KBH/2.73

LEN/1.34

NKE/1.11

PLMO/.20

RHAT/.05

SMSC/.03

Splits

None of note.

Economic Data

NAHB Housing Market Index for September estimated at 70 versus 71 in August.

Weekend Recommendations

Louis Rukeyser's Wall Street had guests that were positive on BMET, MON, COH, WSM, ACL and CMX. Wall St. Week w/Fortune had guests that were positive on CSV. Bulls and Bears had guests that were positive on WFC, LUV, XOM, AA, MAT, mixed on PFE, CSCO, GPS, VIA/B, MSO, NFLX and negative on DIS. Forbes on Fox had guests that were positive on BTU and XRAY. Cashin' In had guests that were positive on SUNW, STEI, AKS, PMCS, HD and negative on VIA/B. Barron's had positive columns on RIG, NEM, PDG, COP, CVX, BHI, MUR and FLYI. Goldman Sachs reiterated Outperform on CAT, EBAY and UST. Goldman reiterated Underperform on EK and F. Ken Fisher, writing for Forbes, is positive on CECO, CRL, CHD and APPB.

Weekend News

Mobistar SA, Belgium's second-biggest mobile-phone company, has chosen Nortel Networks for a UMTS high-speed mobile-phone network, De Tijd reported. Carnival Corp., the largest cruise operator, said it may launch cruise lines in China and India because of their "fast-growing" markets, the Financial Times reported. Britain is ready to send more soldiers to Iraq to reinforce its force before the Middle Eastern country's scheduled elections in January, The Times newspaper said. The union for more than 17,000 Atlantic City casino and hotel workers set an Oct. 1 deadline to agree on a new contract or strike, the Philadelphia Inquirer reported. Yahoo! CEO Terry Semel has emerged as one of the top candidates to succeed Walt Disney Co. Chief Michael Eisner, the San Jose Mercury News reported. About one-third of registered voters in November's U.S. presidential election will have to cast their votes on electronic touch-screen machines, which haven't yet been tested on such a large scale, the NY Times said. OAO Yukos Oil suspended crude-oil deliveries to China National Petroleum Corp. because it couldn't pay for transportation costs, Interfax said. Shares of Eastman Kodak and IAC/Interactive rose late last week on speculation that both companies may be takeover targets, Barron's said. Some members of Iran's parliament are trying to reverse some of the women's-rights reforms carried out under moderate President Mohammad Khatami, the NY Times reported. About 40% of the world's biggest companies had their computer networks infected by viruses in the first half of 2004, the Financial Times said. Deposed Iraqi leader Saddam Hussein an 11 other members of his ousted regime will face trial beginning next month, Iraqi Prime Minister Allawi said. China's efforts to slow the economy are working, Vice Premier Huang Ju said, suggesting further tightening measures such as an interest rate hike may be unnecessary, Bloomberg reported. Iran refused a demand by the United Nations' nuclear watchdog to halt all uranium enrichment activities as the Islamic Republic faces possible sanctions, an Iranian security official said. CBS News ignored the advice of outside experts in rushing to broadcast a report on documents pertaining to President Bush's National Guard service that now appear to be fakes, the Washington Post reported. Southern Co., Duke Energy and other utilities said about 700,000 customers in the southeastern U.S. are without power three days after Hurricane Ivan swept though packing 130-mph winds, Bloomberg said.

Late-Night Trading

Asian indices are higher, +.25% to +1.0% on average.

S&P 500 indicated -.09%.

NASDAQ indicated unch.

BOTTOM LINE: I expect U.S. stocks to open modestly higher in the morning on optimism that economic growth in Asia will accelerate. The Portfolio is 100% net long heading into tomorrow.

Company/Estimate

ADBE/.39

KMX/.27

KBH/2.73

LEN/1.34

NKE/1.11

PLMO/.20

RHAT/.05

SMSC/.03

Splits

None of note.

Economic Data

NAHB Housing Market Index for September estimated at 70 versus 71 in August.

Weekend Recommendations

Louis Rukeyser's Wall Street had guests that were positive on BMET, MON, COH, WSM, ACL and CMX. Wall St. Week w/Fortune had guests that were positive on CSV. Bulls and Bears had guests that were positive on WFC, LUV, XOM, AA, MAT, mixed on PFE, CSCO, GPS, VIA/B, MSO, NFLX and negative on DIS. Forbes on Fox had guests that were positive on BTU and XRAY. Cashin' In had guests that were positive on SUNW, STEI, AKS, PMCS, HD and negative on VIA/B. Barron's had positive columns on RIG, NEM, PDG, COP, CVX, BHI, MUR and FLYI. Goldman Sachs reiterated Outperform on CAT, EBAY and UST. Goldman reiterated Underperform on EK and F. Ken Fisher, writing for Forbes, is positive on CECO, CRL, CHD and APPB.

Weekend News

Mobistar SA, Belgium's second-biggest mobile-phone company, has chosen Nortel Networks for a UMTS high-speed mobile-phone network, De Tijd reported. Carnival Corp., the largest cruise operator, said it may launch cruise lines in China and India because of their "fast-growing" markets, the Financial Times reported. Britain is ready to send more soldiers to Iraq to reinforce its force before the Middle Eastern country's scheduled elections in January, The Times newspaper said. The union for more than 17,000 Atlantic City casino and hotel workers set an Oct. 1 deadline to agree on a new contract or strike, the Philadelphia Inquirer reported. Yahoo! CEO Terry Semel has emerged as one of the top candidates to succeed Walt Disney Co. Chief Michael Eisner, the San Jose Mercury News reported. About one-third of registered voters in November's U.S. presidential election will have to cast their votes on electronic touch-screen machines, which haven't yet been tested on such a large scale, the NY Times said. OAO Yukos Oil suspended crude-oil deliveries to China National Petroleum Corp. because it couldn't pay for transportation costs, Interfax said. Shares of Eastman Kodak and IAC/Interactive rose late last week on speculation that both companies may be takeover targets, Barron's said. Some members of Iran's parliament are trying to reverse some of the women's-rights reforms carried out under moderate President Mohammad Khatami, the NY Times reported. About 40% of the world's biggest companies had their computer networks infected by viruses in the first half of 2004, the Financial Times said. Deposed Iraqi leader Saddam Hussein an 11 other members of his ousted regime will face trial beginning next month, Iraqi Prime Minister Allawi said. China's efforts to slow the economy are working, Vice Premier Huang Ju said, suggesting further tightening measures such as an interest rate hike may be unnecessary, Bloomberg reported. Iran refused a demand by the United Nations' nuclear watchdog to halt all uranium enrichment activities as the Islamic Republic faces possible sanctions, an Iranian security official said. CBS News ignored the advice of outside experts in rushing to broadcast a report on documents pertaining to President Bush's National Guard service that now appear to be fakes, the Washington Post reported. Southern Co., Duke Energy and other utilities said about 700,000 customers in the southeastern U.S. are without power three days after Hurricane Ivan swept though packing 130-mph winds, Bloomberg said.

Late-Night Trading

Asian indices are higher, +.25% to +1.0% on average.

S&P 500 indicated -.09%.

NASDAQ indicated unch.

BOTTOM LINE: I expect U.S. stocks to open modestly higher in the morning on optimism that economic growth in Asia will accelerate. The Portfolio is 100% net long heading into tomorrow.

Sunday, September 19, 2004

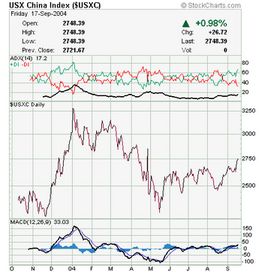

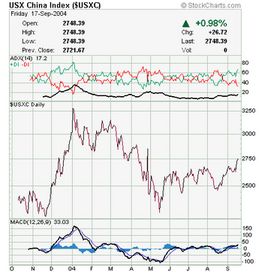

Chart of the Week

The USX China Index

Bottom Line: The China Index began falling in January of this year. It bottomed in May and has been trading in a range since. Last week it broke out of this range and appears to be headed higher as investors anticipate accelerating growth. The USX China Index is still down almost 15% from its highs.

Bottom Line: The China Index began falling in January of this year. It bottomed in May and has been trading in a range since. Last week it broke out of this range and appears to be headed higher as investors anticipate accelerating growth. The USX China Index is still down almost 15% from its highs.

Weekly Outlook

There are several important economic reports and a number of significant corporate earnings reports scheduled for release this week. Economic reports include the Housing Market Index, Housing Starts, Building Permits, Initial Jobless Claims, Leading Indicators, Durable Goods and Existing Home Sales. Housing Starts, Leading Indicators, Durable Goods and Existing Home Sales have market-moving potential.

Adobe Systems(ADBE), Carmax(KMX), Nike(NKE), Autozone(AZO), Red Hat(RHAT), PalmOne(PLMO), Lennar(LEN), General Mills(GIS), Goldman Sachs(GS), Paychex(PAYX), Bed, Bath & Beyond(BBBY), FedEx(FDX), Morgan Stanley(MWD) and Lehman Brothers(LEH) are some of the more important companies that release quarterly earnings this week. There are also a few other events that have market-moving potential. The Fed's interest rate decision/policy statement, Light Reading's Links and Bank of America's Investment Conference could also impact trading this week.

Bottom Line: I expect U.S. stocks to finish the week mixed as earnings worries, profit-taking and violence in Iraq offset diminishing terrorism fears, declining energy prices, falling inflation/interest rate concerns and economic data showing sustainable growth. As well, investor complacency and the market's technically overbought state should lead to further consolidation. The Fed will raise rates 25 basis points on Tues. and likely say that diminishing inflation concerns will continue to allow measured rate increases. My short-term trading indicators are still giving Buy signals and the Portfolio is 100% net long heading into the week.

Adobe Systems(ADBE), Carmax(KMX), Nike(NKE), Autozone(AZO), Red Hat(RHAT), PalmOne(PLMO), Lennar(LEN), General Mills(GIS), Goldman Sachs(GS), Paychex(PAYX), Bed, Bath & Beyond(BBBY), FedEx(FDX), Morgan Stanley(MWD) and Lehman Brothers(LEH) are some of the more important companies that release quarterly earnings this week. There are also a few other events that have market-moving potential. The Fed's interest rate decision/policy statement, Light Reading's Links and Bank of America's Investment Conference could also impact trading this week.

Bottom Line: I expect U.S. stocks to finish the week mixed as earnings worries, profit-taking and violence in Iraq offset diminishing terrorism fears, declining energy prices, falling inflation/interest rate concerns and economic data showing sustainable growth. As well, investor complacency and the market's technically overbought state should lead to further consolidation. The Fed will raise rates 25 basis points on Tues. and likely say that diminishing inflation concerns will continue to allow measured rate increases. My short-term trading indicators are still giving Buy signals and the Portfolio is 100% net long heading into the week.

Market Week in Review

S&P 500 1,128.55 +.41%

Click here for the Weekly Wrap by Briefing.com

Bottom Line: Last week's modest rise was a nice win for the Bulls considering recent gains, violence in Iraq, rising energy prices and hurricane fears. Energy-related stocks and homebuilders were leaders. Most sectors and stocks rose again, while volume and measures of investor complacency remain a concern. I continue to expect oil prices to decline to around $35/bbl. during the fourth quarter, however profitability at energy-related companies will remain high. I expect the Amex Energy Index(IXE) to break to all-time highs during the final quarter of the year. As well, diminishing inflation fears are leading to falling interest rates. The average 30-yr. mortgage rate has now fallen 59 basis points from its May highs. Lower rates, better job prospects and an increasing stock market should help spur home sales and thus homebuilding stocks to all-time highs during the fourth quarter. Finally, Chinese ADRs broke from the trading range they had been trapped in since April. Investors are anticipating a stabilization or acceleration in Chinese economic growth. This should also boost world growth as China had been a recent drag.

Click here for the Weekly Wrap by Briefing.com

Bottom Line: Last week's modest rise was a nice win for the Bulls considering recent gains, violence in Iraq, rising energy prices and hurricane fears. Energy-related stocks and homebuilders were leaders. Most sectors and stocks rose again, while volume and measures of investor complacency remain a concern. I continue to expect oil prices to decline to around $35/bbl. during the fourth quarter, however profitability at energy-related companies will remain high. I expect the Amex Energy Index(IXE) to break to all-time highs during the final quarter of the year. As well, diminishing inflation fears are leading to falling interest rates. The average 30-yr. mortgage rate has now fallen 59 basis points from its May highs. Lower rates, better job prospects and an increasing stock market should help spur home sales and thus homebuilding stocks to all-time highs during the fourth quarter. Finally, Chinese ADRs broke from the trading range they had been trapped in since April. Investors are anticipating a stabilization or acceleration in Chinese economic growth. This should also boost world growth as China had been a recent drag.

Subscribe to:

Posts (Atom)